Bevan commenced its regulatory journey to become a UK authorised bank during the first Covid19 lockdown of 2020. Idling at home pondering the potentially seismic impact of a global pandemic on the UK’s post Brexit uncertainty, I undertook brief but mostly enthusiastic lockdown initiatives such as bursts of Joe Wicks exercise (half a session), a brief foray into bread-making (one loaf) and a highly successful (potentially too much so) indoor plant growing project. Hearing the neighbours clapping and banging pans on their doorsteps on the evenings where we’d shuffled in various states of loungewear got me pondering there must be a better way to practically help public sector workers who, in their literally hundreds of thousands and across multiple segments from healthcare to administration via education and border security, were suddenly tasked with keeping the UK afloat and safe in a sea of rapidly changing uncertainty.

Clapping felt a bit, well… small…

The house buying aspirations of the UK’s public sector are well documented. Often stuck in private rentals with rents only ever going up. House prices increasing faster than they can save for a deposit. They remain a political problem, regardless of government. There are only two ways we can level the playing field for low paid public sector workers: we can build many many more houses and therefore demand will level off or we can give them massive pay rises. Neither of which, I’m afraid, is very likely. I’m happy for Boris’ successor to prove me wrong.

According to the Public Accounts Committee in April 2022, 13% of privately rented properties pose “a serious threat to the health and safety of renters”. This costs the NHS about £340 million in treating the subsequent health problems caused by these properties. I can well believe it. My own brother rented one inside the M25 whilst serving as a police officer in the Met. The black spores steadily growing across their bathroom had to be seen to be believed. The resulting and recurring winter chest infections from his wife and kids were inevitable. £340m in the NHS would be pretty handy at the moment, wouldn’t it?

So what could be done?

As industry professionals we need to be doing much more to make an effort to lend to lower paid workers. We need to get more public sector workers into their own homes. We need to lend smart so they can afford their mortgage repayments by lending for longer and take into account often inconsistent but generally available overtime pay, to take into account deployment pay for the armed forces, on call allowances, unsociable hours payments and above all, we need to lend responsibly so we’re not stretching them financially when they’re already likely overstretched physically and mentally in their careers. For older consumers, we want to support their future financial health and well-being by providing responsible and affordable later life lending products and solutions, pertinently for those coming off Interest Only products taken out in the heady pre-crisis days.

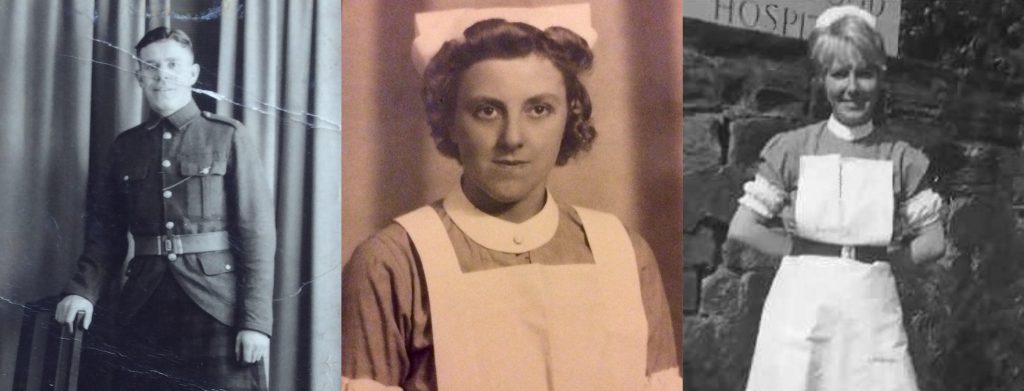

Totting up my own immediate family’s record of public sector experience includes 50 years in the army, 30 years in the Prison Service, 20 years in the NHS and 25 years in the Police. I grew up in married quarters, moving around from house to house, school to school, making new friends and losing contact with many others as we followed my dad around the country marvelling at the many shades of magnolia paint seemingly endlessly available to the MoD or Home Office.

After a reasonably long career in finance and IT, I’d been working in the last decade with many firms applying for banking or lending or consumer credit licences (13 at the last count) but in the majority of cases, (with one or two notable exceptions, they know who they are), they seemed to focus on the wrong things. It takes a fair amount of confidence, talent, skill and acumen to exploit an opportunity. Not everyone can exploit an opportunity by making sure both sides can benefit.

So Bevan Money was born.

Inspired by Nye Bevan, but in admiration of that great politician’s skills and vision as a housing innovator as much as his NHS achievement. Bevan has been developed to provide effective mortgage lending solutions for lower paid public sector workers to get them on the housing ladder, to provide them with financial security, to provide their families with stability, to provide the communities they live in with anchored families spending in local shops and attending local schools they won’t have to say goodbye to because the tenancy has ended or because a parent has been posted.

Watch this space. Current, future and retired public sector workers. We see you.

Mel Lane

CEO, Bevan Money